Living Longer in the Greatest Mortality Revolution in Modern Times

The number-one fear in retirement is outliving your money. Market volatility, excessive withdrawal rates and the sequence of returns have all contributed to the fear factor among seniors outliving their money. But now these risks are exacerbated in light of the greatest mortality revolution in modern times.

Watch the interview with Kevin Bard, Investment Advisor, Charter Federal Employee Benefit Consultant and author of “The Retirement Umbrella.”

The fastest-growing segment of our population is age 65 and up. By 2030, according to the U.S. Census Bureau, 1 in 5 Americans will be over age 65. By 2060, that group will grow to include 1 in 4 Americans. And it’s not just America. It’s happening in Europe and Asia as well. There may come a time—perhaps in our lifetime—when adult diapers out will out sell child diapers.

People are living longer. We all know people who are living well into their 80s and 90s, but are you prepared for you, your family and friends to live to age 95 to age 105 as a matter everyday life? That means we’ll all be living more years in retirement. That’s what’s fueling the number-one concern of running out of money.

It’s often said the number-one fear for most people is speaking in public. Death was number two. Now, living longer may have passed death, out of the sheer fear of outliving your money.

During your working years, you worried about running out of money before the end of the month. Now, as a retiree, you worry about running out of money for a whole decade. This isn’t fear mongering, and it isn’t trafficking in some kind of psychonomic phobia. This is a very real and present danger for the average American female, who is estimated to live 88.8 years, meaning half of them will exceed that age.

For many people, the fear of running out of money is a legitimate fear. There are factors that actually can take a big bite out of our hard-earned retirement savings. They include additional items like taxes, inflation, stock-market risk, interest-rate fluctuations, health care costs, long-term care needs, probate and estate planning.

One of the biggest factors we can control is procrastination. It’s that very human tendency to put off ’til tomorrow what could (and usually should!) be done today. How often do we manage to convince ourselves there will be plenty of time later to make sound financial decisions? Taking action now and not putting it off can go a long way toward protecting your retirement savings. (This press release contains segments from chapter one of “The Retirement Umbrella.”)

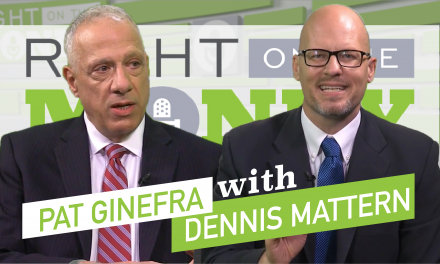

Syndicated financial columnist Steve Savant interviews Investment Adviser Representative and author of the Retirement Umbrella Kevin Bard. Right on the Money is a weekly financial talk show for consumers, distributed as video press releases to 280 media outlets and social media networks nationwide.